Cost code dynamic rates

Cost codes in Ontraccr can also be used to implement custom billing and wage calculations, giving your company flexibility in terms of how you'd like to track costs and revenue across different activities.

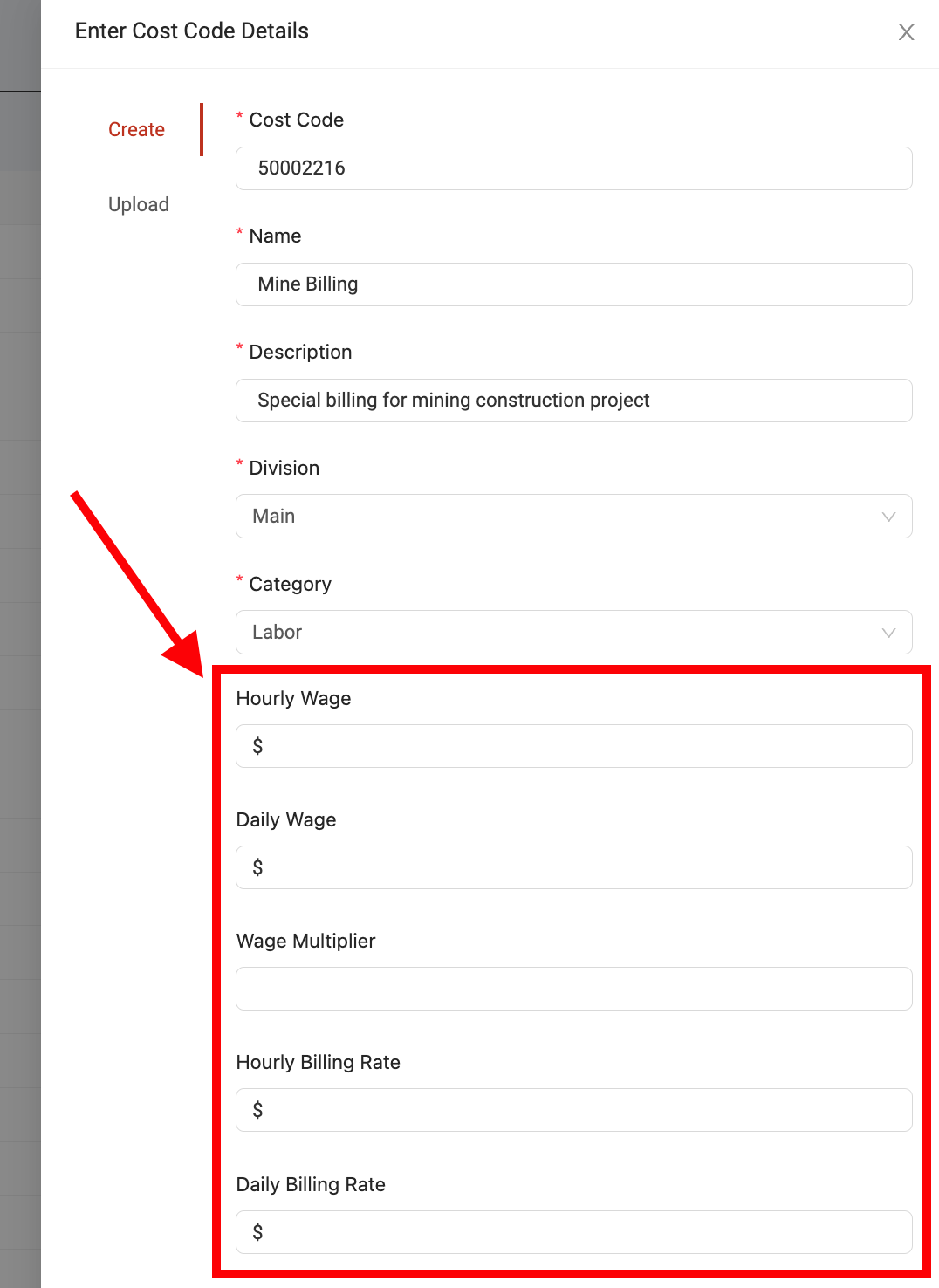

When adding or editing a cost code, you'll notice the following additional fields at the bottom of the cost code profile:

- Hourly Wage

- Daily Wage

- Wage Multiplier

- Hourly Billing Rate

- Daily Billing Rate

These are optional fields that can be configured. These fields can apply special calculations whenever users track time using them.

Configuring dynamic rates

Wage rates

By default, when a user tracks time for a cost code in Ontraccr, the base time will use the user's default wage which is set up in the user's profile. However, if the cost code uses a special wage rate, then the cost code will override the user's wage and apply the special wage for the time tracked using the special cost code.

There are three possible wage rate configurations you can apply to a single cost code: hourly wage, daily wage, or a wage multiplier. You can only configure up to one of these wage rates per cost code. In other words, you can't configure both an hourly wage and daily wage for a cost code since that would present a calculation conflict.

Therefore, once you begin configuring one of these three options in the cost code's profile, you'll notice that the other two options will be disabled.

Hourly wage

The Hourly Wage option will set up a custom hourly wage rate for the cost code. When a user tracks time using this cost code, it will simply override the user's default hourly wage (in their profile) with the hourly wage specified in the cost code. This will override the user's wage with the cost code's hourly wage, regardless of whether it is higher or lower.

Daily wage

The Daily Wage option will set up a custom daily wage rate for the cost code. When a user tracks time using this cost code, it will completely override the user's default hourly wage (in their profile) and ignore the number of hours entirely. Instead, it will apply a blanket daily wage for any time tracked for the cost code. For example, if the user tracks time for a cost code with a custom daily wage of $200, then their wage will be $200 for the day regardless of the number of hours they tracked for the cost code.

Please note:

- Multiple different daily wage cost codes can be used in the same day for a single user, in which case the user's wage for the day would be the sum total of all the different daily wage cost codes they tracked time for in the day.

- If the same user tracks time for the same daily wage cost code across separate entries on the same day, then it will only charge the daily wage once across the multiple entries for the same daily wage cost code.

Wage multiplier

The Wage Multiplier option will set up a simple multiplier for the cost code. When a user tracks time using this cost code, it will multiply the user's default hourly wage (in their profile) by the custom wage multiplier set up in the cost code. For example, if a user's wage is $20 per hour and they track time for a cost code with a 1.5x multiplier, then their hourly wage will be $30 for every hour of time tracked for the special cost code.

Billing rates

There are many ways to handle billing in Ontraccr. Another option is to use cost codes to implement special billing rates for any time tracked for the cost codes. Billing rates will not affect user wage calculations in any way, as wage and billing calculations are handled completely separately by Ontraccr.

There are two possible billing rate configurations you can apply to a single cost code: hourly billing rate or daily billing rate. You can only configure up to one of these billing rates per cost code. In other words, you can't configure both an hourly billing rate and daily billing rate for a cost code since that would present a calculation conflict.

Therefore, once you begin configuring one of these two options in the cost code's profile, you'll notice that the other option will be disabled.

Hourly billing rate

The Hourly Billing Rate option will set up a custom hourly billing rate for the cost code. When a user tracks time using this cost code, it will simply apply the hourly billing rate specified in the cost code, regardless of whether it is higher or lower than the user's hourly wage.

Daily billing rate

The Daily Billing Rate option will set up a custom daily billing rate for the cost code. When a user tracks time using this cost code, it will completely ignore the number of hours entirely. Instead, it will apply a blanket daily billing rate for any time tracked for the cost code. For example, if the user tracks time for a cost code with a custom daily billing rate of $300, then the billing rate will be $300 for the day's work regardless of the number of hours they tracked for the cost code.

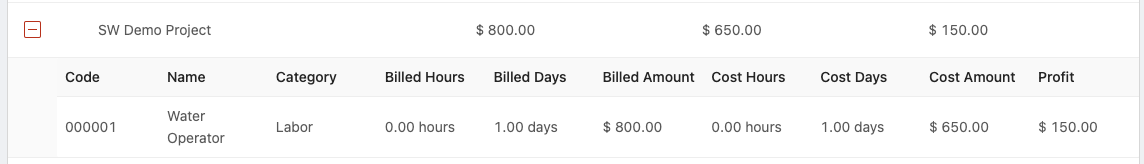

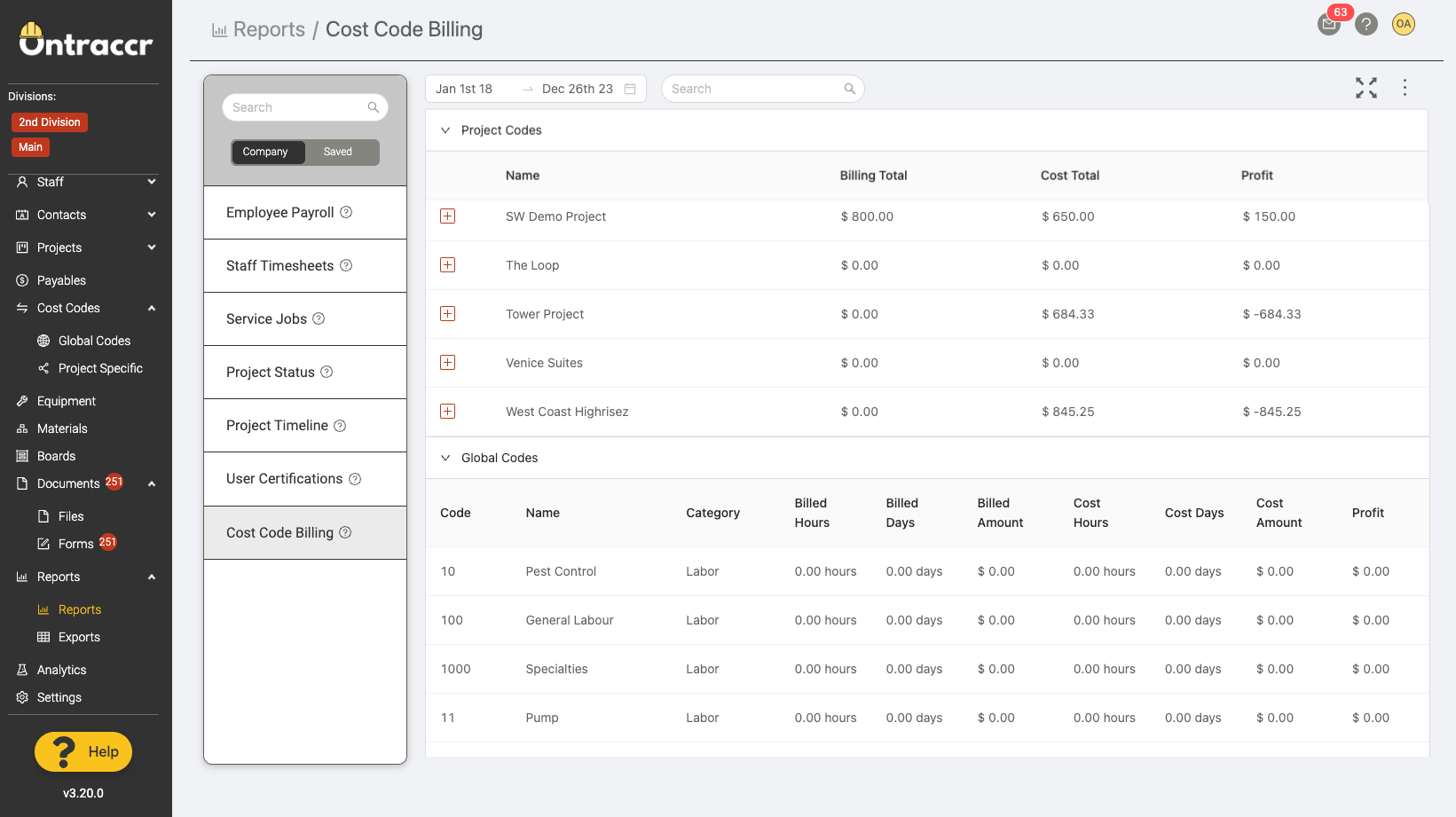

Viewing cost code calculations using the 'Cost Code Billing' report

The calculations for all of the dynamic cost codes will be available and organized cleanly in the 'Cost Code Billing' report. To view this report, open the Reports > Reports page and open the Cost Code Billing report.

The report is categorized into sections by the two categories of cost codes: project-specific cost codes and global cost codes. Within each section, you will see a detailed breakdown of all the tracked time and automatic wage/billing calculations captured by the special cost codes with dynamic rate configurations.

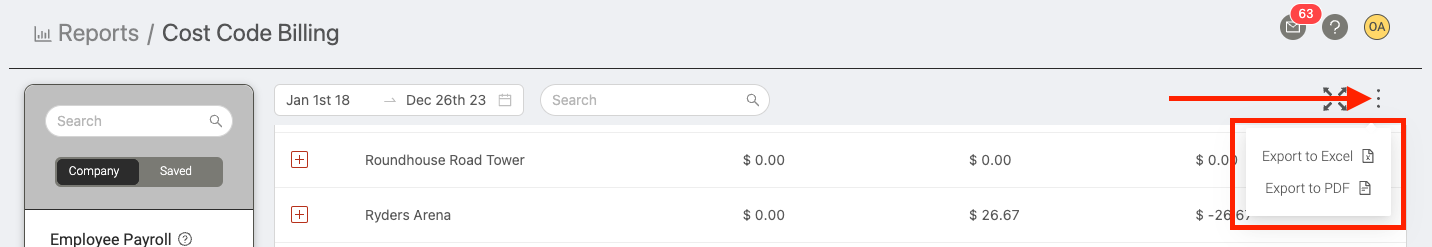

By default, the report is filtered by pay period but you can use the date filter in the top left corner to filter by any time frame and the report is also fully searchable using the search bar at the top. The data in the report can be exported into an excel or pdf file at any point. To export the report, click the 'more' icon in the top right corner of the page and select the export format you'd like.